For most workers, payday is the most anticipated day on the calendar. Therefore, pay frequency, or how often they get paid, could affect their decisions on when they decide to purchase particular goods and services or pay for living expenses.

Are there regulations on Pay Frequency?

Over 64% of Americans are living paycheck to paycheck, according to a May 2022 LendingClub survey. The real question is how long the period between paychecks is. Many think a federal government regulation like the Federal Labor Standards Act (FLSA) determines pay frequency. However, no federal law states how often a person must be paid. Courts have interpreted FLSA to say employers must keep a consistent pay frequency, meaning they cannot intermittently change the interval between pay periods without a legitimate and permanent reason.

The subject of pay frequency has been left up to the States or municipalities, with only three states not having a law regarding pay frequency (Alabama, Florida, and South Carolina). State regulations vary, including Weekly, Bi-weekly, Semi-monthly, and Monthly. In addition, these regulations can vary by occupation or if the employee is overtime-exempt. Over 3/5 of states have rules for hourly employees to be paid at least semi-monthly. Interestingly, the requirement for pay frequency in Washington, Oregon, and Idaho are all monthly. The U.S Department of Labor maintains a State Payday Requirements List annually.

Why is Pay Frequency Important?

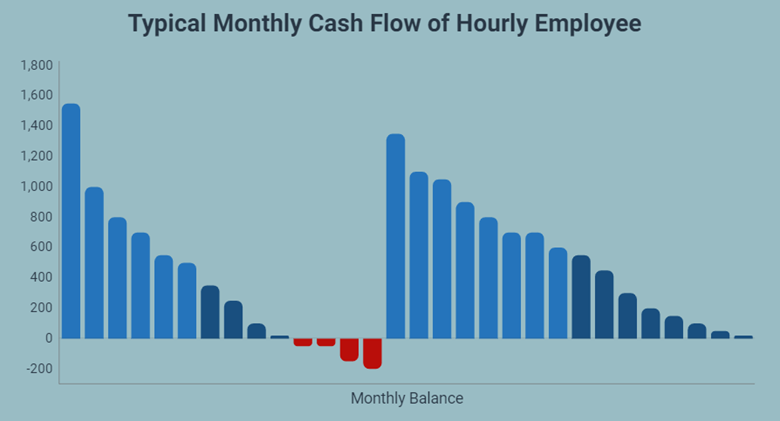

Pay Frequency’s importance comes down to household cash flow. The chart below shows a typical person’s cash flow if they are paid semi-monthly.

Frequently, because of significant expenses at the beginning of the month, there is a period in the middle of the month where they are in the negative. This negative cash flow can affect an employee’s ability to focus or even get to work.

It is not that the employee has not earned their wages. They just do not have access to it until payday.

According to a Harris Poll, 83% of U.S. workers believe they should have access to their earned wages at the end of each workday or shift. In addition, 78% said on-demand pay would increase loyalty to an employer.

A recent payroll survey stated that 62% of employees indicated alternative pay frequencies or options would make a difference in their decision to accept a job offer. This information is notable in our current labor environment.

How does an employer help increase pay frequency without increasing costs?

Most payroll companies charge companies a per person or per check fee plus a base monthly fee. Therefore, the more times a company processes payroll, the higher the costs. Because of this, the more payroll cycles an employer has, the higher the costs.

However, there is a better way with Earned Wage Access (EWA). EWA is a benefit that allows employees to access a portion of their wages as they earn them rather than waiting until the end of the pay period. Advances are reconciled from funds in their next paycheck. This process is handled by a third party who accepts the risks of the advance and releases the burden from a company’s payroll department. This access helps employees survive financial hardships, especially when emergencies arise.

Looking at the employee cash flow chart above, an employee uses EWA to get $200 advanced to their account on wages they have already earned four days before their mid-month paycheck. Then, on their mid-month paycheck, this $200 is deducted from their direct deposit before it hits their bank account. In addition, the employee avoids overdraft fees or high-interest payday loans with this on-demand access. Finally, better EWA services offer this service at no cost to the employer or employee.

How can we help?

Pay on Demand offers all the elements businesses should look for in an Earned Wage Access solution at no cost to employees or employers. In addition, this solution delivers peace of mind by immediately giving employees access to a portion of their earned wages.

For more information about Pay on Demand, contact Time Equipment Company at 800-997-8463 or sales@timeequipment.com.

*This information simplifies complex Acts as it is understood by Time Equipment Company. It is not to be taken as legal advice. The regulations for this program are changing. For further information, contact your state or local Department of Labor.