Regulations, both federal and state, surrounding Earned Wage Access providers are continuing to evolve. Fintech startups saw the growing need to allow employees early access to their earned wages and, of course, make money in the process. Many Fintech companies charge a ‘nominal fee’ to allow employees immediate access to their earned wages. They argue the nominal fee is far less than Payday Loan fees that would yield a triple-digit annual percentage rate (APR).

In December 2020, the Consumer Financial Protection Bureau (CFPB) released an advisory opinion concluding Earned Wage Access providers do not involve the offering or extension of credit under the Truth in Lending Act (Reg Z) if they meet the following characteristics:

- Funds advanced to the employee may not exceed the employee’s accrued cash value of wages earned up to the date of the transaction. In other words, access can only be for wages earned, and not on future wages.

- The employee is not charged any fees including opening an account, delivery of funds, or use fees.

- The provider is repaid for the advance only through an employer-facilitated payroll deduction from the employee’s next paycheck. No more than one additional attempt to obtain the funds is possible if the first attempt fails.

- The provider cannot have recourse, direct or indirect, to employees for payment. No debt collection activities are possible.

- The creditworthiness of employees cannot be taken into consideration when offering the advance transaction, including obtaining or reviewing an employee’s credit report or credit score.

There are currently eight states experimenting with legislation: New Jersey, New York, North and South Carolina, Georgia, Utah, Nevada, and California. Most are like the CFPB opinion especially regarding the inability to charge fees to the employee.

Is offering Earned Wage Access worth it?

In the competition for today’s labor, the company with the best pay and benefits usually wins. Many companies offer medical insurance and paid time off, but other benefits could separate them from other employers. In a recent payroll survey, 62% of employees indicate alternative pay frequencies or options would make a difference in their decision to accept a job offer.

According to a recent survey of U.S. workers, 73% state financial stress as the most significant source of stress in their life. Earned Wage Access providers can help employees, especially in an emergency, get access to wages they have already earned.

The FDIC reports over 7 Million U.S. Households are unbanked or underbanked. This means no one in the household has a checking or savings account at a bank or credit union. Unbanked/underbanked rates are higher among Black, Hispanic, American Indian, Alaska Native, and disabled households at three times the national average.

Providing Earned Wage Access allows your company to be an Employer of Choice.

What should employers look for in an Earned Wage Access provider?

Employers should look for the following in an Earned Wage Access provider:

- Ensure the provider does not charge employees fees for opening an account, wage advances, or transfers

- Certify the provider is backed by a federally regulated brand network

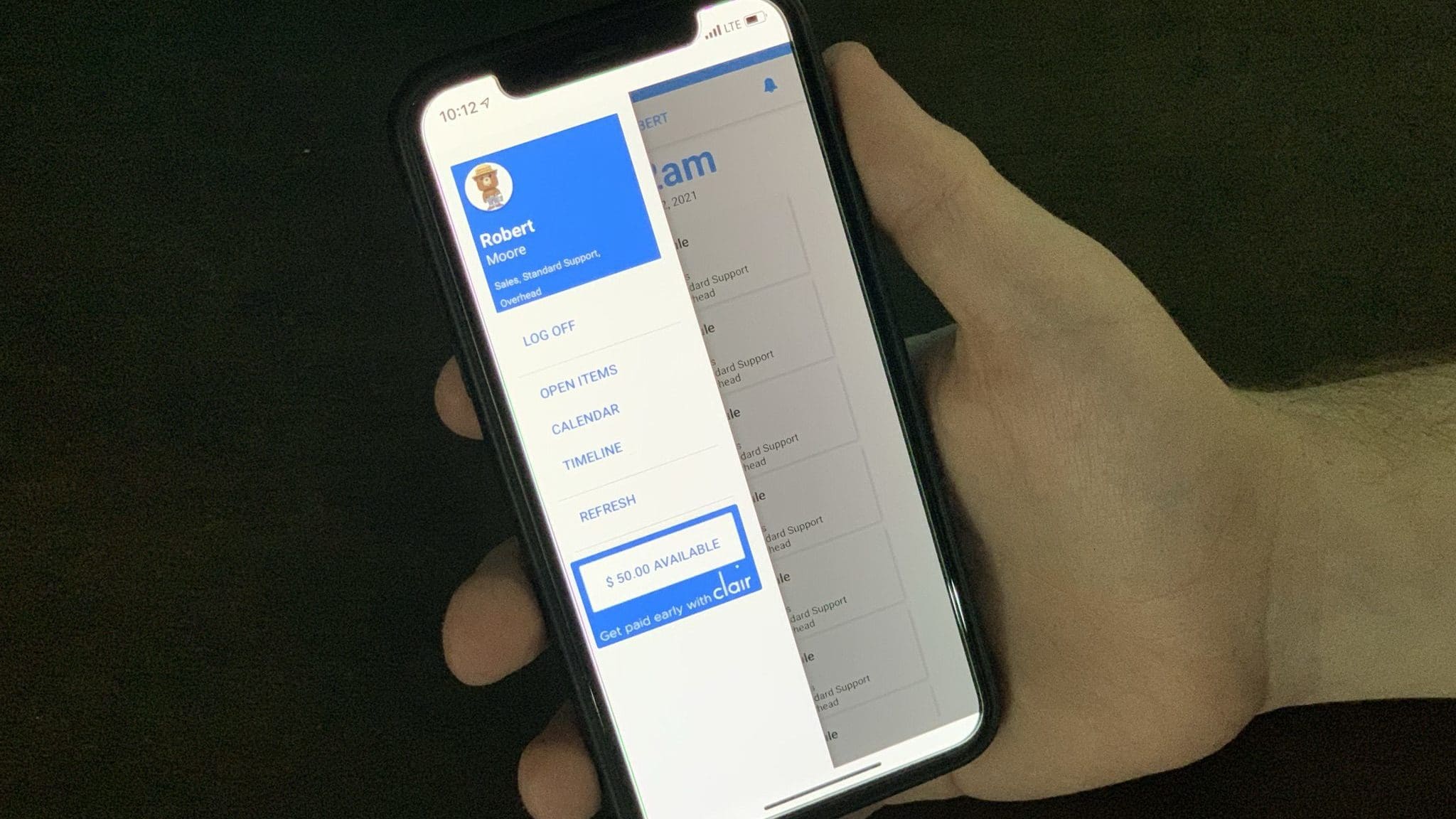

- Ensure the provider integrates seamlessly with your time and attendance system to track earned wages at the end of their daily shift

- Offering an earned wage access service should provide no undue burden on your payroll department

- You should always check with a legal team to ensure that the provider follows all federal and state regulations

How Can We Help

Pay on Demand offers all the elements employers should have in an Earned Wage Access provider at no cost to your employees or your company. For more information about Pay on Demand, contact Time Equipment Company at sales@timeequipment.com or 800-997-8463.

*This document simplifies complex information as it is understood by Time Equipment Company. It is not to be taken as legal advice. The guidelines are consistently changing. For further information, please visit consumerfinance.gov.