Paycheck Protection Program

Tuesday, June 30th is the last day the Small Business Administration (SBA) accepts applications for the Paycheck Protection Program. The PPP program provides low interest loans to small businesses with up to 500 employees, as well as to self-employed entrepreneurs. Business owners and entrepreneurs who receive loans can later apply to have some or all of the loan forgiven by the SBA if they meet the program’s criteria.

The CARES Act has provided federal guarantees to almost $519 billion in loans from banks and other private lenders to nearly 4.8 million small businesses and nonprofits as of Saturday, June 27th according to the SBA. However, there are still more than $134 billion in guarantees still available through this program.

Recent changes to the program include requiring at least 60% of loan proceeds be used for payroll instead of the original 75%. This to allow business owners to allocate more funds to static costs like rent and mortgage. The SBA also extended the use of loan from eight weeks to 24, as businesses brought their people back in increments.

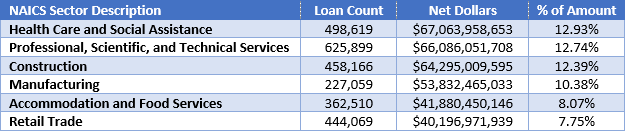

The top 6 sector categories comprise 64% of the PPP loans approved by the SBA.

In addition, 66% of approved loan applications were $50,000 or under with the average loan amount being $108,000.

While legislation has been introduced to extend this deadline for some borrowers, nothing has passed either house of Congress.

Economic Injury Disaster Loan

In response to the Coronavirus (COVID-19) pandemic, small business owners in all U.S. states, Washington D.C., and territories can apply for an Economic Injury Disaster Loan advance of up to $10,000. This advance is designed to provide economic relief to businesses that are currently experiencing a temporary loss of revenue. This loan advance will not have to be repaid.

The Deadline for EIDL is September 30th.

*This document simplifies complex Acts as it is understood by Time Equipment Company. It is not to be taken as legal advice. The regulations for this program are changing. For further information about the Economic Injury Disaster Loan please visit www.sba.gov or www.coronavirus.gov